How Can Ripple, Stellar, And Chainlink Solve Cross-Border Payment Issues?

Let's see how this trio can solve issues like high costs & slow transfers pertaining to cross-border payments.

We know that $170 Billion is transacted around the World every hour. But issues like high costs & slow transfers exist with cross-border payments.

Globalisation, market expansion, and tech innovation show reliance on cross-border payments.

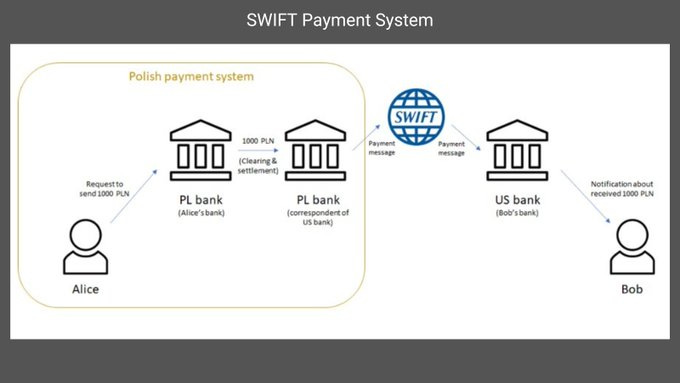

But the available Solutions like SWIFT have two major issues:

Additional costs if the payment has to be processed through intermediary banks.

Slow transaction speed

Both of the above issues can be solved by doing direct transfers instead of relying on intermediaries. Blockchain solutions such as Ripple, Stellar, & Chainlink for cross-border transfers can make this possible.

Stellar Stellar connects financial institutions for cross-border payments using its blockchain network and IBM's World Wire platform. Lumens (XLM), Stellar's native cryptocurrency, is used for faster and cheaper transactions compared to SWIFT.

Stellar aims to replace SWIFT by facilitating cross-border payments for SMEs and individuals using a complex system involving depository institutions, stablecoins, and transaction capabilities.

The platform uses blockchain technology and the Stellar Consensus Protocol for a well-functioning infrastructure. Users deposit money at certified local depository institutions recognized as "anchors" by Stellar.

Key features of Stellar:

• Fast processing: 2k TPS, validated in 5 seconds for cross-border payments

• No middleman: direct transactions via self-triggering smart contracts

• Decentralized: efficient transfer without relying on a central authority What about

Ripple

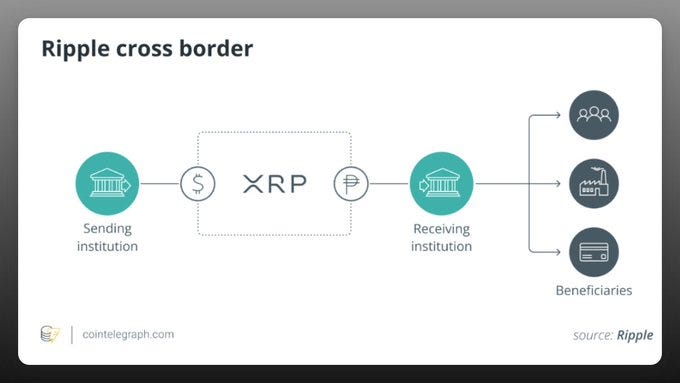

Ripple partners with global banks and financial institutions to promote technology adoption and enable wider use of XRP for cross-border payments. Key partners include Santander, American Express, SBI Holdings, and PNC Bank.

Ripple's blockchain-based payment protocol, utilising XRP, allows real-time, low-cost cross-border transactions. It eliminates the need for multiple intermediary banks, resulting in faster settlements and reduced costs.

SWIFT has a global reach, but replacing it with Ripple is uncertain due to SWIFT's influence and the regulatory challenges faced by Ripple. However, when decentralized cross-border payments are favoured, Ripple will be ideal.

SWIFT is evolving.

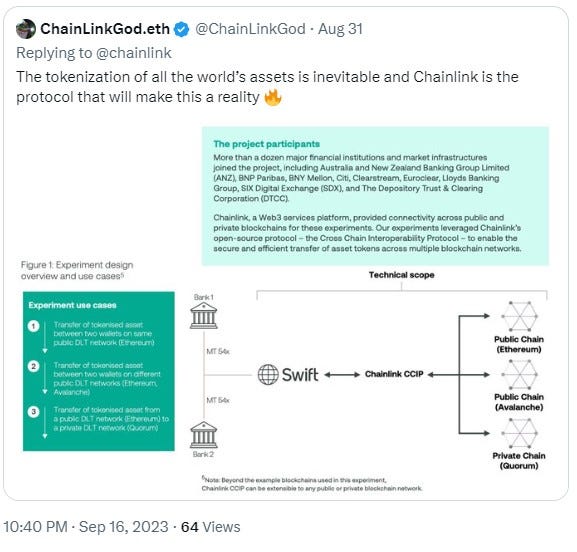

It is active in conducting experiments to highlight tokenization's importance. Working with financial institutions, SWIFT demonstrated the significance of its network by facilitating tokenized asset transfers across multiple routes.

Benefits from tokenization

Tokenization is in its initial stages, with 97% of institutional investors convinced it will change asset management. It will increase effectiveness, reduce costs, and offer more options for investors through fractional ownership.

The most important Collaboration: SWIFT and Chainlink have partnered to address blockchain fragmentation and improve tokenized asset transactions.

Chainlink's Cross-Chain Interoperability Protocol (CCIP) launched on the mainnet. It offers a plug-and-play option for transferring tokens between chains, supporting both the burn-and-mint and lock-and-mint methods.

SWIFT aims to improve interoperability and the user experience by partnering with Chainlink. This collaboration streamlines access to multiple networks, reducing operational challenges and costs for tokenized assets.

Chainlink is leading the charge towards a future where tokenization of all global assets is an undeniable reality. Get ready for a groundbreaking transformation!

Chainlink offers services like data transfer, token transfer, blockchain communication, and computational services. Key services for tokenizing capital markets include CCIP, Proof of Reserve for auditing reserves, and Functions for synchronising off-chain events or data.

Chainlink enables $8 trillion+ in transaction value for blockchain apps, secured by decentralized oracle networks operated by major enterprises like Deutsche Telekom MMS, LexisNexis, and Swisscom. Maintains high uptime and tamper-proof security, even during volatility.

Conclusion

The future of payments is moving towards a hybrid model. Combining established payment systems with digital currencies is the next step towards full financial decentralization.

Really well put together!

Really well put together!