How does LandX want to position itself in the $15Trillion RWA market?

In this post, let's look at how LandX acts as a bridge between farmers and crypto investors.

$15Trillion is the expected Market Cap of RWA in Crypto by 2030.

According to Statista, almost $5 trillion in agriculture revenue will be realized in 2028 alone.

What is LandX?

LandX brings real-world production to DeFi with tokenized agricultural commodity vaults.

It provides the opportunity to raise capital for farmers and earn real yield for Crypto investors.

What problem does LandX solve?

Crypto investors don't have the opportunity to invest in farmland commodities and earn real yield.

LandX provides the opportunity to earn a sustainable yield by bridging the gap between farmers and blockchain technology.

How LandX works?

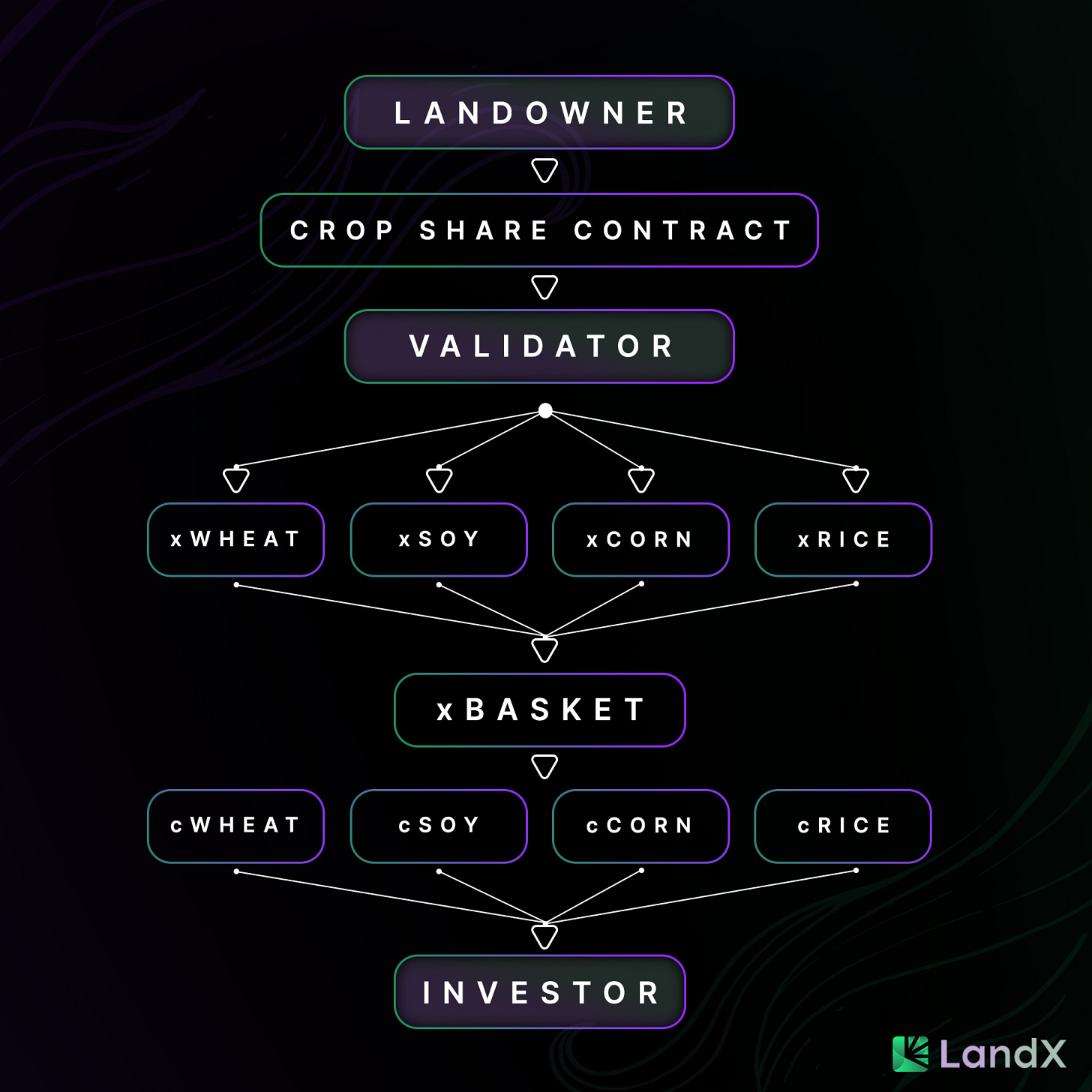

Farmers raise capital from LandX in exchange for regular crop share payments.

Crop share payments are tokenized on Eth chain to create xTokens.

xTokens produce real yield in the form of cTokens.

cToken or commodity token represents 1kg of product like Rice, Soy, Wheat or Corn.

Lets take the example of Wheat.

Investors can stake 1xWheat to earn 1cWheat per year.

The earned cTokens can be exchanged for USDC at the market value of 1KG wheat.

xTokens

The xToken perpetual vaults are the primary investment product of LandX.

xTokens offer two important benefits to investors:

Portfolio diversification

Inflation Edge

Portfolio diversification is can be done through exposure to uncorrelated assets.

Agricultural commodities, in the past, have moved independently of the stock market and crypto market.

Inflation hedge because yield payments are made in cTokens which track the value of the underlying commodity.

If the value of the USD falls over time relative to food products then the yield increases in USD terms due to the payment being calculated on 1KG of the product.

cTokens

cTokens are derivatives designed to track the price of an agricultural asset.

They are the real yield produced by xTokens and represent 1kg of a commodity.

cTokens are tradeable via an internal marketplace and can be exchanged for USDC.

Portfolio Diversification

The cToken which acts as a yield for the xToken, tracks the value of the underlying commodity.

If the value of the USD falls relative to food products, then the yield increases in USD terms since payment is calculated based on 1KG of the product.

Inflation hedge

The cTokens which act as yield for xTokens tracks the value of the underlying commodity.

If the value of the USD falls over time relative to food products, then the yield increases in USD terms due to the payment being calculated on 1KG of the product.

Ecosystem Participants

The three participants in the ecosystem are:

Farmers

Validators

Investors

Farmers

Farmers are responsible for maintaining production on their land and timely payment of their crop share obligations.

Validators

They are responsible for onboarding new farmers, vetting land production and validating legal contracts.

Investors

Investors provide the demand for potential inflation hedged xTokens and cTokens minted by the protocol, which powers the LandX ecosystem.

Governance

LandX is structured as a decentralized autonomous organization (DAO) with voting rights belonging to holders of the LNDX governance token.

LNDX Token Model

LandX offers something relatively unique in DeFi markets; real yield from real-world production.

LNDX value accrual ensures stakeholders' interests are aligned with the project.

Validators are required to stake LNDX tokens as part of their commitment to the land agreements they set up.

Platform Fees

LNDX token holders earn a percentage of platform fees from the xToken yield. Platform fees are set at 10% initially and distributed in USDC as follows:

60% LNDX token holders

35% LandX Treasury

5% LandX Choice The TGE is nearing and date will be announced soon.

Liquidity Provision

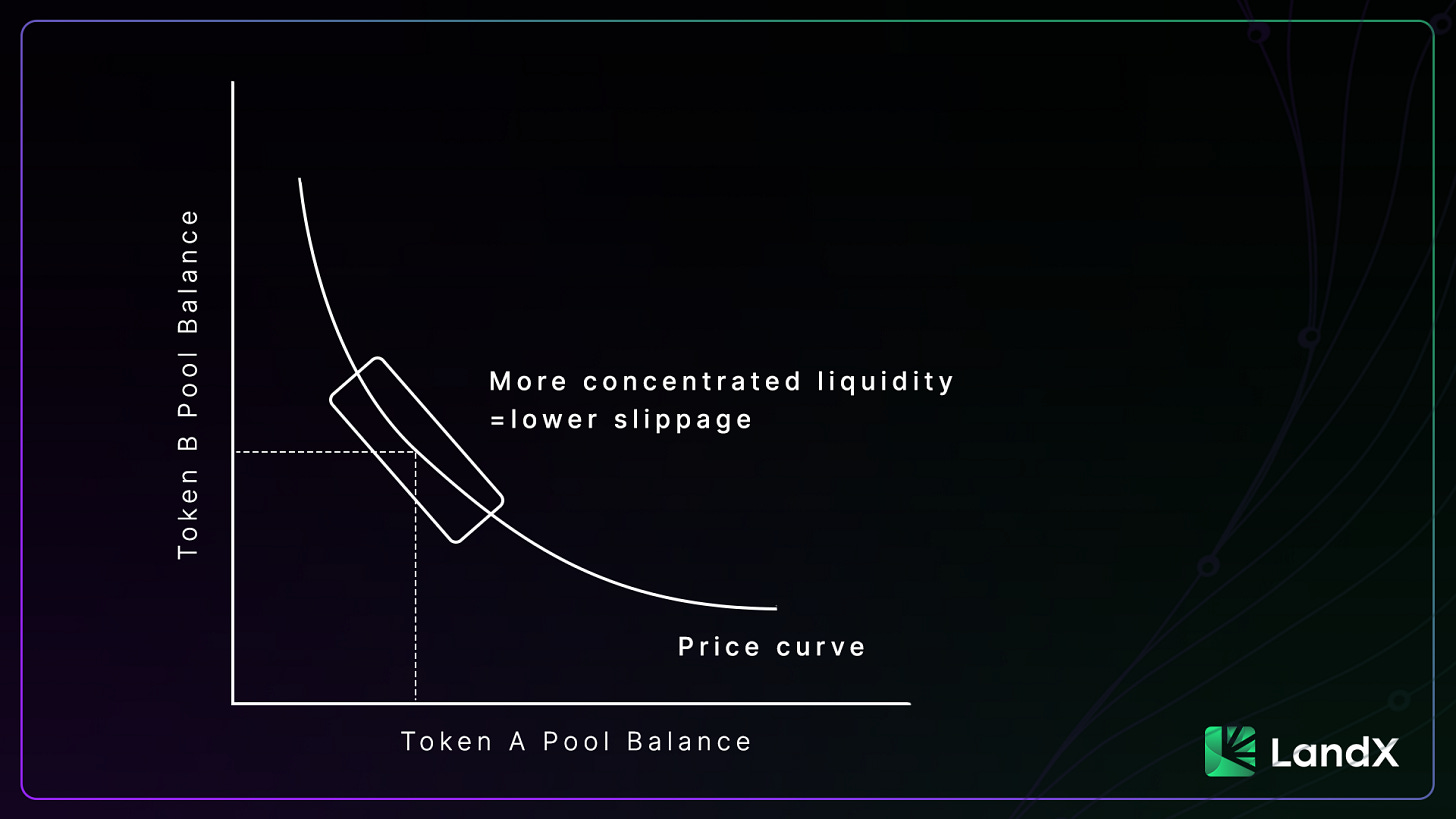

Liquidity providers earn trading fees for providing this service at a rate of 0.3% per trade on standard pools.

An LP (liquidity provider) will deposit a pair of assets to a liquidity pool in order to earn trading fees on that pair.

For example, an LP can provide xSOY and USDC to the xSOY/USDC market on Uniswap. A trader can then come along and purchase the xSOY token with USDC.

This increases the balance of USDC in the xSOY/USDC pool and decreases the amount of available xSOY.

This imbalance in the pool creates a shift in the price using the constant product formula:

x × y = k

x and y represent the pool balance of each token, and k is the total constant price of the pool creating the following price curve.

Audit

LandX has completed a comprehensive security audit by one of the world’s leading security contract auditor, Quantstamp.

Conclusion

LandX is an open,transparent,decentralized marketplace that connects farmers with Defi investors and part of the RWA narrative.

I have written this in partnership with LandX because I believe that it provides a great opportunity to investors as well as farmers.